100% Financing Options: Your Path to Homeownership with Zero Down Payment

100% Financing Options: Your Path to Homeownership with Zero Down Payment

Published on October 29, 2025

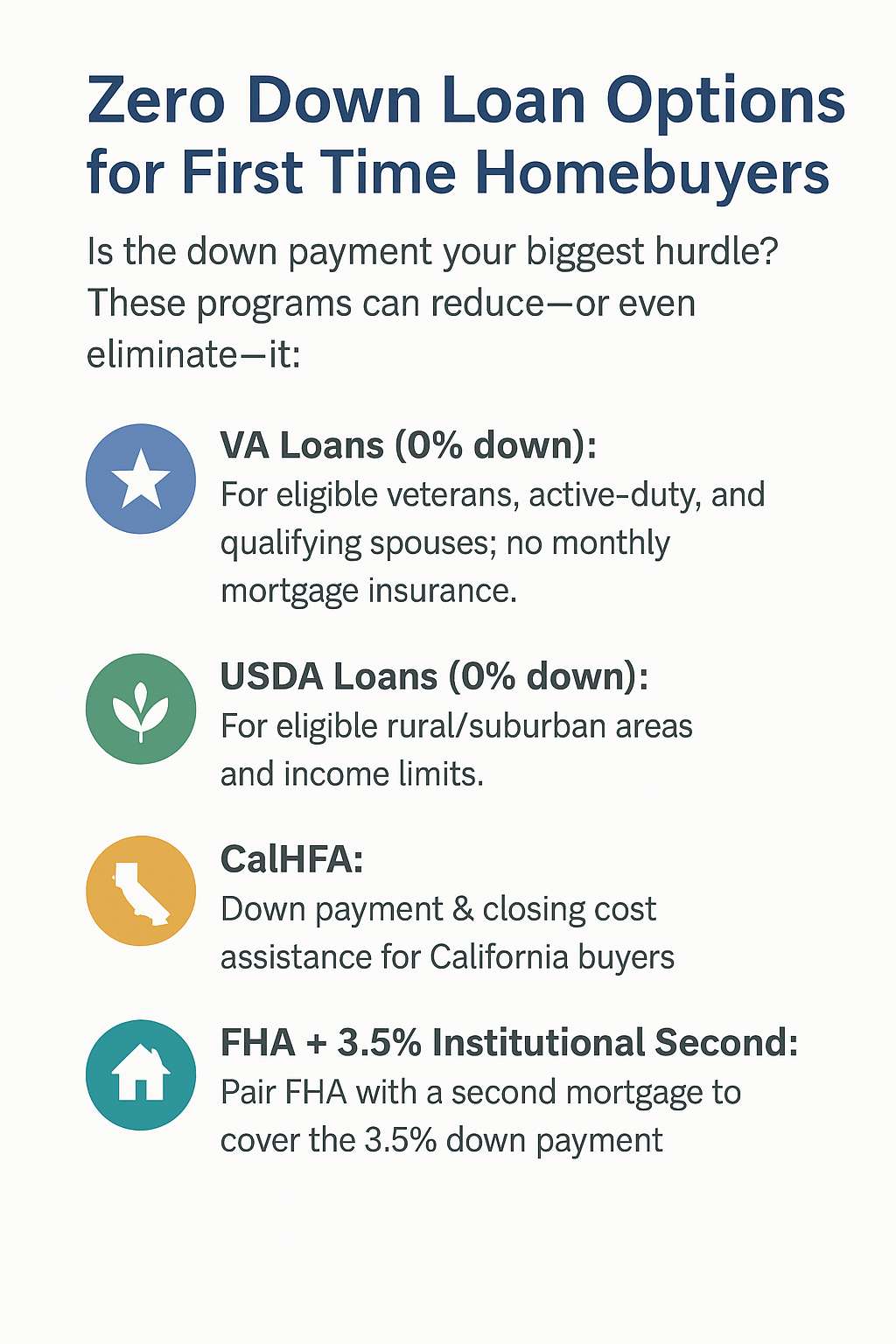

Are you dreaming of owning a home but worried about saving for a down payment? At First Capital Mortgage Inc., we specialize in 100% financing options that make homeownership possible without a penny down. These programs are perfect for first-time buyers, veterans, rural residents, or anyone looking to minimize upfront costs. Let's break down the key options and what you need to know.

True 0% Down Programs (No Second Mortgage Required)

These government-backed loans cover the full purchase price without layering on additional debt:

- VA Loans: Exclusive to eligible veterans, active-duty service members, and surviving spouses. Benefits include:

- 0% down payment

- No PMI (Private Mortgage Insurance)

- Competitive interest rates

- Flexible credit requirements

Eligibility: Based on military service. Schedule a call with Steve to confirm eligibility →

- USDA Loans: Designed for rural and suburban homebuyers with moderate income.

- 0% down payment

- Low mortgage insurance costs

- Income limits apply (based on Area Median Income)

- Property must be in a USDA-eligible area

Tip: USDA loans take lots of detail - set up a call with Steve to review your area and income.

100% Financing with Second Mortgages (Down Payment Assistance)

These programs combine a primary mortgage with a secondary loan or grant to cover the down payment:

- FHA with Down Payment Assistance:

- Primary loan: 3.5% down required

- Second mortgage/grant: Covers the 3.5% (or more)

- Examples: Chenoa Fund, CALHFA

- Repayment: Some are forgivable after a set period; others are low-interest loans

- Conventional with Assistance:

- Programs like HomeReady or Home Possible

- Often paired with local or state grants

- May require PMI but can be removed later

Low Down Payment Alternatives (3 - 5% Down)

If 100% financing isn't the right fit, these options keep your upfront costs minimal:

- FHA Loans: 3.5% down (as low as 580 credit score)

- Conventional 97: 3% down for first-time buyers

- First-Time Homebuyer Programs: State-specific assistance (e.g., Tennessee Housing Development Agency)

Key Qualifying Factors

Every 100% financing options program has unique rules. Here's what lenders evaluate:

| Factor | Why It Matters | Example Restrictions |

|---|---|---|

| Credit Score | Determines eligibility and rate | VA/USDA: ~620+; FHA: 580+; Assistance: Varies |

| Income | Must fit program limits | USDA: 115% of AMI; Assistance: Often <80% AMI |

| Location | Geographic eligibility | USDA: Rural/suburban only - Ask Steve |

| Debt-to-Income | Ensures affordability | Typically ≤43 - 50% |

| Property Type | Must meet program standards | Primary residence only (most cases) |

Pro Tip: Get fully pre-approved before house hunting. A soft credit check won't hurt your score and gives you a clear budget. Start pre-approval HERE →

Real Talk: Pros & Cons of 100% Financing

| Pros | Cons |

|---|---|

| No down payment required | Higher monthly payments (due to PMI/MIP) |

| Faster path to homeownership | Stricter income/location rules |

| Build equity immediately | Second mortgages may need repayment |

Why Homeownership Matters: Building a Legacy for Generations

At First Capital Mortgage Inc., we believe homeownership is more than a financial decision - it's an investment in your family's future. Research shows profound differences in outcomes for children raised in owned homes versus rentals, with even greater impacts when considering racial disparities. Let's explore the evidence.

Impact on Children: Stability Leads to Success

Children growing up in owned homes experience significant advantages in school and later life compared to those in rental households. Studies using nationally representative data reveal that young and school-aged children in owned homes show superior math and reading skills, fewer behavioral problems, and better cognitive outcomes - up to 9% higher in math achievement. Homeownership fosters residential stability, reducing school mobility that disrupts learning; frequent moves are linked to lower reading scores and higher dropout risks.

Long-term, these children are more likely to graduate high school, attend college, secure better jobs, and avoid teen pregnancies or welfare dependency. For instance, adult children of homeowners are 1.6 times more likely to own homes themselves, perpetuating wealth-building cycles. In contrast, rental instability - exacerbated by evictions or landlord sales - upends lives, forcing changes in schools, friends, and communities, which can lead to chronic absenteeism, grade repetition, and lifelong setbacks. As you noted, "love and charity start at home," but instability disrupts the entire family fabric.

Parental Outcomes: Work, Retirement, and Security

Parents who own homes enjoy greater financial flexibility, enabling better work-life balance and robust retirement planning. Homeowners build equity that acts as a safety net, allowing earlier retirement - often at 65 versus 68 for renters - who must save 50% more (8x salary vs. 5.25x) due to perpetual rent costs. Homeowners' net worth grows or stabilizes in retirement, while renters decumulate assets rapidly.

Economically, homeowners hold 40 times the median wealth of renters ($400,000 vs. $10,400), with 15x more in retirement accounts and business interests. This stems from equity appreciation, tax deductions, and downsizing options, freeing funds for healthcare or leisure. Renters, burdened by rising costs (up 16% yearly), cut spending on essentials and save less, heightening stress and delaying retirement. For parents, ownership means modeling resilience - maintaining homes teaches responsibility, boosting children's self-esteem and future prospects.

Racial Overlay: Deeper Disparities, Greater Stakes

Racial disparities amplify these benefits, making homeownership a critical equity tool. White households' homeownership rate (72%) dwarfs Black (42%) and Hispanic (51%) rates, fueling a wealth gap where Black families hold just 15% of white families' wealth. Black children in owned homes gain outsized educational boosts - higher test scores, lower absenteeism - yet systemic barriers like redlining and discriminatory lending limit access.

Closing the gap could shrink the racial wealth divide by 31%, enhancing family stability and breaking poverty cycles. For minority families, ownership means resilience against evictions (disproportionately affecting Black households) and better neighborhoods with quality schools. Without it, disparities compound: Black parents' lower home equity (15x less) restricts down payment gifts, perpetuating inequality for children. The impacts are profound - healthier outcomes, upward mobility, and generational healing - proving homeownership's role in improving lives for every American.

Now Is Your Time

We are adding you to our refinance list in anticipation of the expected rate cut. As a reminder, your first payment was on 4/1/2024, and you will need to make six regularly scheduled payments before we can pay off your old loan.

What is most important during a refinance?

Please take a moment to consider the best goal for you from your refinance:

- Lower your monthly payment.

- Pay off your loan sooner.

- Achieve a balance between the first two.

- Debt consolidation for improved cash flow. When we assisted with your purchase, you had very little other debt. If you have made or are planning home improvements, now is a good time to consider debt consolidation.

Feel free to reach out if you have any questions or would like to discuss your goals further. We're here to help you make the most informed decision.

Thank you for choosing us for your mortgage needs. Have a blessed day.

Best regards,

Next Steps for You

- Complete a Full Application: Takes ~15 minutes online at CLICK HERE. or just call 209-522-7100

- Upload Documents Securely: DOCUMENTS REQUESTED

- Get Personalized Options: We'll review your credit, income, and goals to match you with the best program.

Ready to explore 0% down? Call/text 209-522-7100 or schedule a consultation HERE. We'll guide you every step of the way.

BLOG by

Steve McNeal

NMLS 256426

Broker| First Capital Mortgage Inc.

steve@firstcapitalmortgageinc.com

(209) 522-7100 | Text/SMS| Schedule Call

First Capital Mortgage Inc. - NMLS #2228346 (Licensed only in CA) and NMLS #2527671 (Licensed in NV and TN). Equal Housing Lender.

Programs subject to credit approval and underwriting guidelines.

Verify your loan officer at www.nmlsconsumeraccess.org.

References

1 National Bureau of Economic Research, 2019

2 Urban Institute, 2021

3 Georgetown University CEW, 2020

4 Federal Reserve SCF, 2022