AI Real Estate Tech Trends 2026: Market & Rate Signals

AI, Real Estate Tech & the Direction of Interest Rates: What Top Agents Already Know

As we wrap up 2025, it’s crystal clear: the real estate and mortgage world isn’t just evolving - it's accelerating at warp speed. Roughly two years ago, I made a bold decision to reinvent my business at First Capital Mortgage Inc., diving into AI and real estate tech, advanced CRMs, and modern systems that are reshaping how top agents grow their business. Today, if you’re a savvy real estate agent aiming to dominate your market, you already know that mastering these tools isn't optional - it's essential.

The top-producing agents in 2026 will be the ones who actively embrace AI, leverage modern systems, and surround themselves with lenders who do the same. If you’re a real estate agent who already operates with a growth mindset, then you're probably already nodding your head - because you've seen the gap widening between agents who adapt and agents who fall behind.

And if you're the kind of agent who wants to stay ahead of your competitors rather than react to them, this is exactly the moment to lean in. Sharpen your edge over competitors. Reach out now at (209) 522-7100 (call or text) or email

Steve@FirstCapitalMortgageInc.com and let’s transform your 2026 game plan.

Why AI and Real Estate Tech Matter Now More Than Ever

Identifying eager homebuyers and guiding them seamlessly to pre-approval and escrow is still the foundation of any high-performing agent's success. The core requirements haven't changed much in 30+ years - buyers still need to provide income documentation, assets, employment history, and credit details (with some tweaks for investors or self-employed clients buying a primary home).

The rise of AI and real estate tech is accelerating the way agents communicate, qualify buyers, and compete in fast-moving markets.

What has changed is how quickly buyers expect answers, how seamlessly they expect updates, and how many agents and lenders they interact with digitally before choosing who to trust. That's where AI and real estate tech go from "nice to have" to "must have." When used correctly, AI doesn't replace your relationships - it amplifies them.

Over twenty years ago, Steve Polson (then with Red Carpet Realty) ran a national study and discovered that the average homebuyer engaged with 56 different real estate agents between starting their search and receiving their keys. If that was the number back then, imagine what it looks like today with reels, TikToks, AI-generated ads, and push notifications every time a listing hits the market.

Here's the strategic question:

If your buyers are interacting with dozens - or even hundreds - of agents online, what ensures you remain the one they come back to?

This is where AI plus a coordinated lender - agent partnership creates a decisive advantage.

- Respond faster and more consistently so buyers feel seen and supported.

- Keep buyers from drifting or feeling forgotten when life gets busy.

- Increase conversion from "curious click" to "buyer with keys in hand."

- Shorten the time from first contact → pre-approval → escrow.

- Create a smoother, more predictable experience for buyers and sellers.

Agents who stay close to their buyers win.

Agents who automate that process - with the right partner and the right systems - win big.

If you want a refresher on how we walk buyers through the loan process step by step, you can also share our guide on

understanding the mortgage process

with your clients.

The #1 Concern Buyers Have Today: Affordability & Rates

Homebuyers are asking one question more than any other:

"What will interest rates do next?"

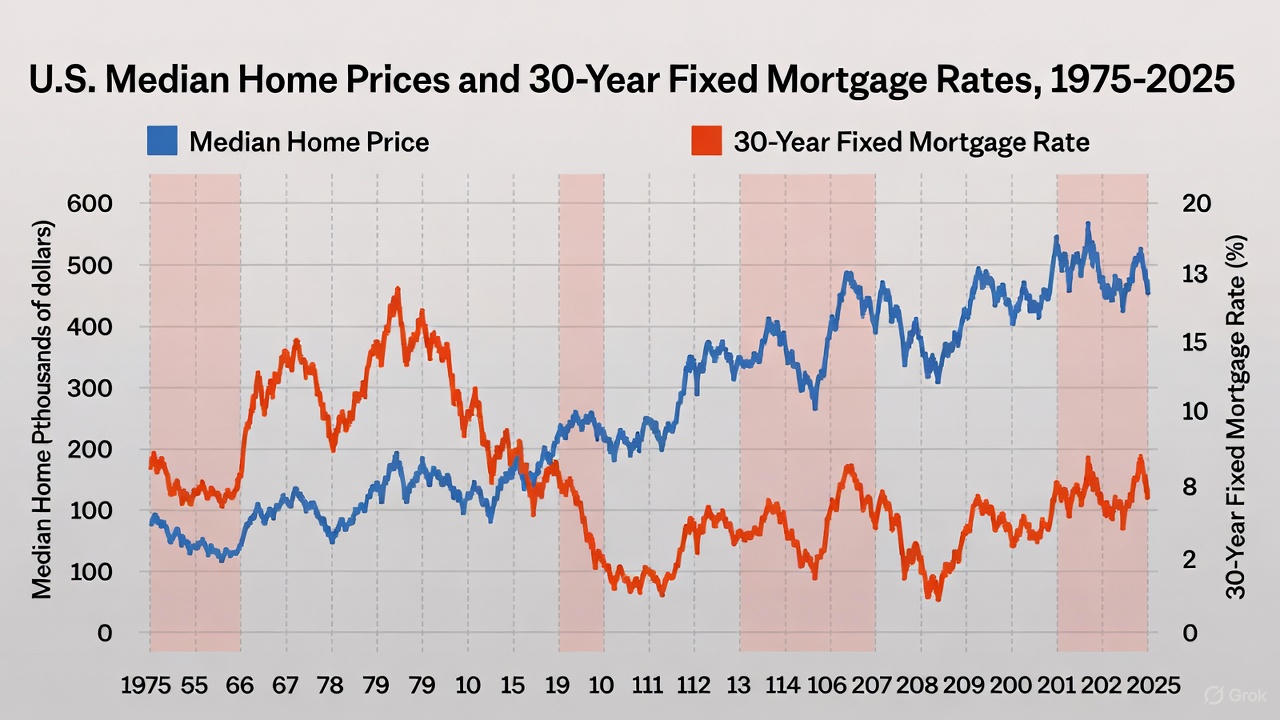

After nearly four decades of studying market cycles, Fed policy, and mortgage-rate behavior, one thing remains constant:

Confident buyers make confident offers. Uncertainty kills momentum. It kills dreams.

With the Fed's December 10 - 11, 2025 meeting and policy statement, we have clearer insight into the likely direction of rates heading into 2026.

The Federal Reserve's own FOMC statement gives us the framework to understand where policy is headed and how markets may respond.

Agents who understand this narrative - even at a high level - are already positioning themselves as the "trusted advisor" their clients need.

As AI and real estate tech continue to evolve, agents who embrace these tools will outperform those who don't.

Here's the solution-awareness question:

What would it do for your business if your buyers understood exactly why rates move, how the Fed influences those movements, and what to expect in the next 30, 60, and 90 days?

When we partner together, you get real-time breakdowns, plain-English explanations, and weekly updates you can forward to your clients - keeping you top-of-mind and trusted.

For deeper consumer-facing education on affordability, you can also point clients to resources like our

Central Valley housing affordability guide

.

The #2 Concern: "How Much Do I Need to Put Down?"

Today's buyers - especially first-time homebuyers, who make up a huge portion of the current market - want clarity on:

- How their income qualifies.

- Whether bonuses, overtime, or commissions count.

- What to do if they've been at their job less than two years.

- Whether a thin credit profile helps or hurts them.

- What low- or no-down-payment options exist.

- Whether there are assistance programs available in their area.

These buyers don't just need a lender. They need a game plan.

And when you position yourself as the agent who brings them that game plan - paired with a lender who can execute it - buyers naturally view you as their guide, and they stay loyal.

This is where confirmation bias works in your favor: agents who attract educated buyers already see themselves as the "trusted advisor" in their market. Partnering together simply reinforces that identity in a powerful, tangible way.

Need a practical example? When tax or escrow questions pop up, we give your buyers clarity with pieces like our

supplemental tax bill explainer

and our article on

mortgage escrow benefits and risks

. You don't have to answer everything yourself - your value is in knowing where to take them.

Let's Look Ahead Together

The agents who dominate next year will be the ones who combine:

- AI and human connection instead of choosing one over the other.

- Market knowledge and clear communication instead of confusing jargon.

- Strong systems and strong partners instead of trying to do everything alone.

And if you're reading this far, you already know you're not the agent who waits for the market to tell you what to do. You're the one who stays ahead of it.

Here's the commitment question that matters:

Would a quick strategy call help you strengthen the way you guide buyers and position yourself for an exceptional 2026?

If you’re curious, I'd love to talk about how we can support your clients, streamline your workflow, and increase your buyer conversion.

Call, text, or email me anytime at (209) 522-7100 - I'm here to help you win.

And if any of your friends, family, or co-workers are looking to buy, sell, or refinance, can I count on you to introduce us via text or email?

Start Your Pre-Approval

Move from “shopping” to “offer-ready” in hours, not weeks.

Was this helpful?

If this guide added value, a quick Google review helps others find us.