Buying a home in 2025 is one of the smartest moves you can make.

Why Buyers Are Choosing to Buy a Home in 2025

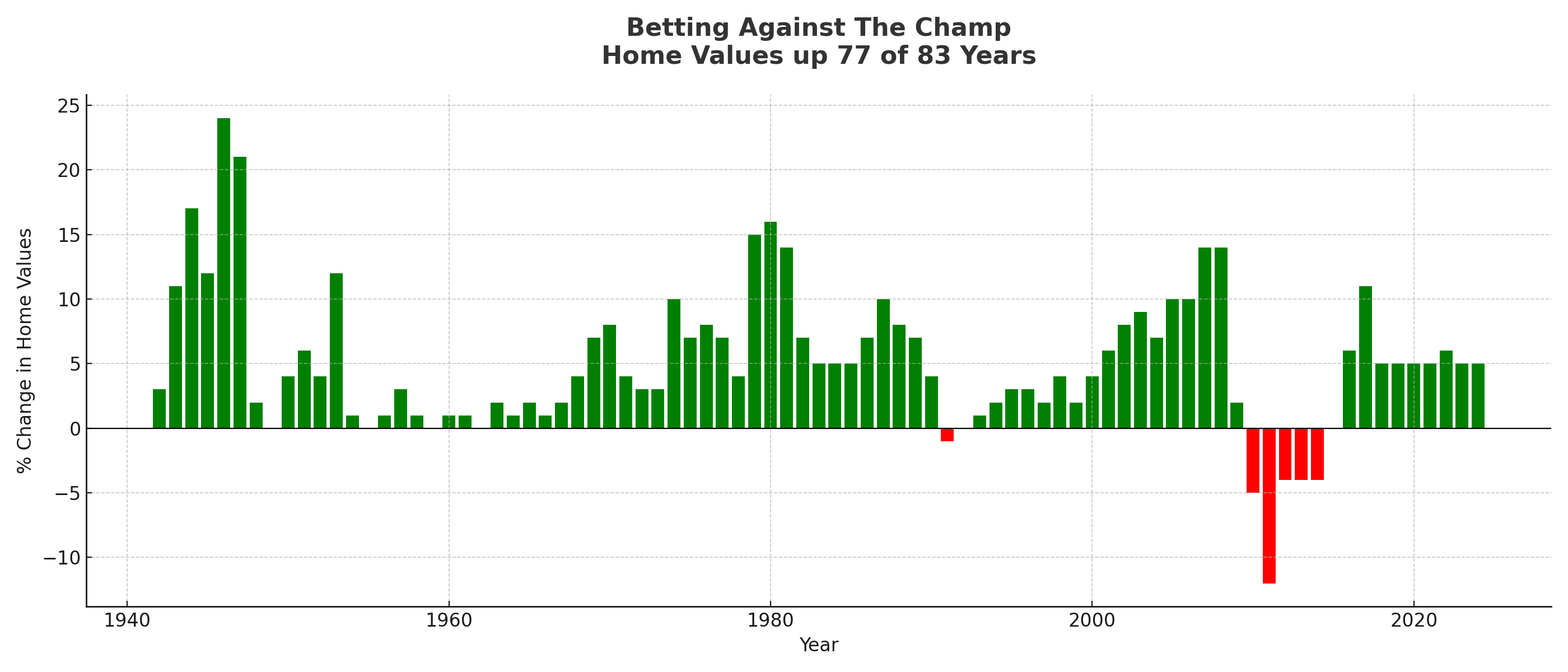

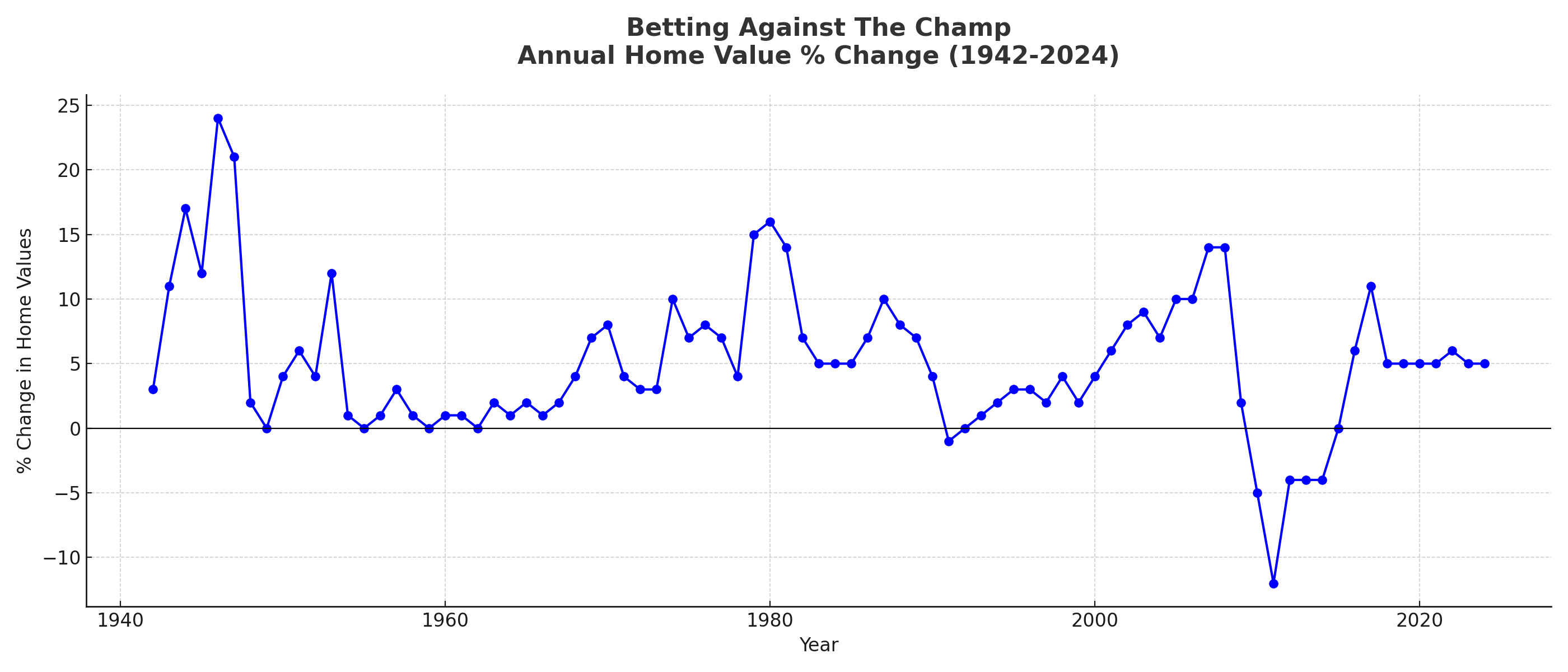

If you're considering whether to buy a home in 2025, history shows it's still one of the smartest wealth-building moves you can make. Home values have risen in 77 of the last 83 years, and today's conditions - lower rates, more inventory, and more flexible sellers - give you leverage we haven't seen in a while.

The Facts: Housing Wins Over Time

Over eight decades, home values climbed the majority of years despite recessions, wars, and policy shifts. Time in the market beats trying to perfectly time the market. If your life goals point to ownership, 2025 is a rational window to act.

Problem Awareness: If rates or rents move against you while you wait, what could that cost over 12 months?

Solution Awareness: If you could secure the right home now and improve your rate later, how would that affect your confidence and cash flow?

Consequence: If competition and prices rise again, what would delaying mean for you?

Commitment: Would a 20-minute plan review help you decide?

Why Buyers Are Choosing to Buy a Home in 2025

1) Mortgage Rate Relief & Financial Leverage

Rates have eased from cycle highs, improving monthly payments and purchasing power. Acting before the next move lets you lock in today's math and refinance later if conditions improve.

2) More Inventory & Negotiation Room

Active listings are up year-over-year in many markets, and sellers are more open to concessions and closing-cost credits. More choice + more flexibility can mean better terms for prepared buyers.

3) Stability, Equity, and Inflation Protection

Ownership provides a stable payment and an appreciating asset. Whether it's your first purchase or a move-up, a plan to buy a home in 2025 builds equity while rents continue to float higher.

"Marry the Home, Date the Rate" - The Practical Play

Find the right home now; optimize the rate later. We structure purchases to win today and tomorrow:

- Seller-paid buydowns to reduce your initial payment.

- Refinance readiness so you can capture future rate drops efficiently.

- Payment planning aligned to your next 12 - 24 months.

That's why many clients choose to buy a home in 2025 and implement a refinance trigger plan rather than wait for a perfect rate that may never arrive.

Local Notes: Central Valley, CA & Knoxville, TN

Central Valley (Modesto, Merced, Turlock): Selection is better than in the frenzy years, and affordability remains favorable compared with coastal California - good conditions to buy a home in 2025 with concessions strategy.

Knoxville, TN: Continued job growth and inbound moves keep demand steady. Improved inventory has created a window for well-prepared buyers to negotiate.

📅 Schedule a Consultation

Get a custom plan to buy a home in 2025 - tailored numbers, negotiation angles, and a refinance roadmap.

✅ Start Your Pre-Approval

Strengthen your offer, know your exact numbers, and move faster when the right home hits.

FAQ

Is 2025 a good time to buy a home?

Yes. With easing rates, improved selection, and long-term appreciation, 2025 offers real opportunities for buyers who act strategically.

What does "marry the home, date the rate" mean?

Secure the right home now and plan to refinance if/when rates drop. You protect against rising prices and still keep the door open to a lower payment later.

How can I reduce my payment today?

We'll evaluate seller credits, temporary/permanent buydowns, and product selection (conventional, FHA, VA, bank-statement, DSCR, etc.) to optimize your total monthly cost.

Further Reading

- What a Fed Rate Cut Could Mean for Mortgage Rates in 2025

- Why Acting Now on Home Loan Rates Can Save You More

- NAR Research & Statistics

First Capital Mortgage Inc., serving California and Tennessee, has provided personalized mortgage services for over 30 years. Whether you’re a first-time homebuyer, self-employed, refinancing, or seeking fast funding, we simplify the mortgage process to meet your unique needs.