Economic & Market: What the Fed’s Moves Mean for Mortgage Rates

Fed Rate Cut Mortgage Rates 2025: What It Means for You

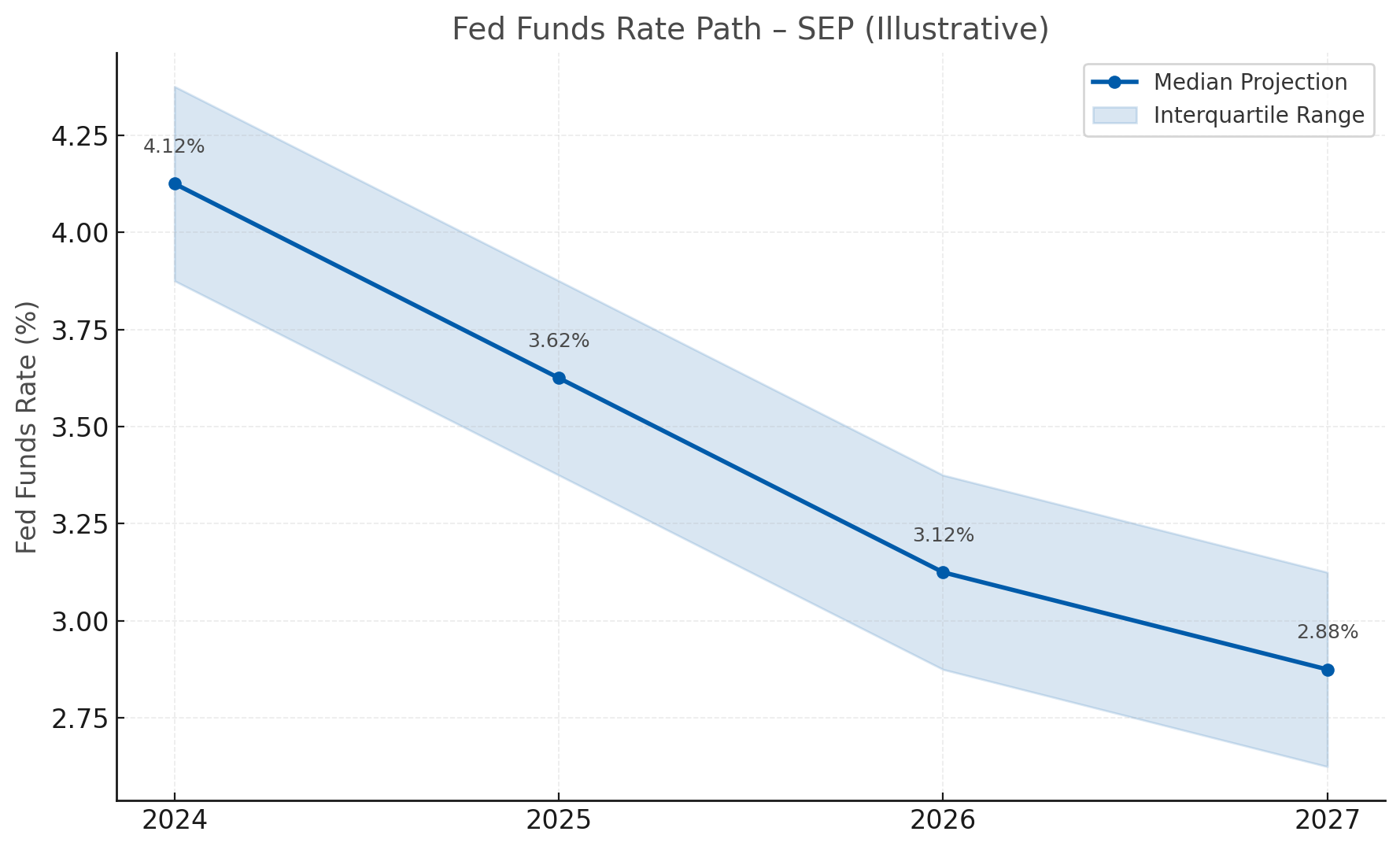

The Fed rate cut mortgage rates 2025 outlook is coming into focus. Markets remain cautious, so mortgage rates can be sticky and volatile even as the Fed eases policy. Below is a clear plan for buyers, homeowners, and investors to protect affordability and act fast when opportunity appears.

Fed Rate Cut Mortgage Rates 2025: Key Takeaways

- The Fed cut by 0.25%; policy is still restrictive but easing.

- Unemployment is edging higher while inflation progress is uneven, keeping bond investors cautious.

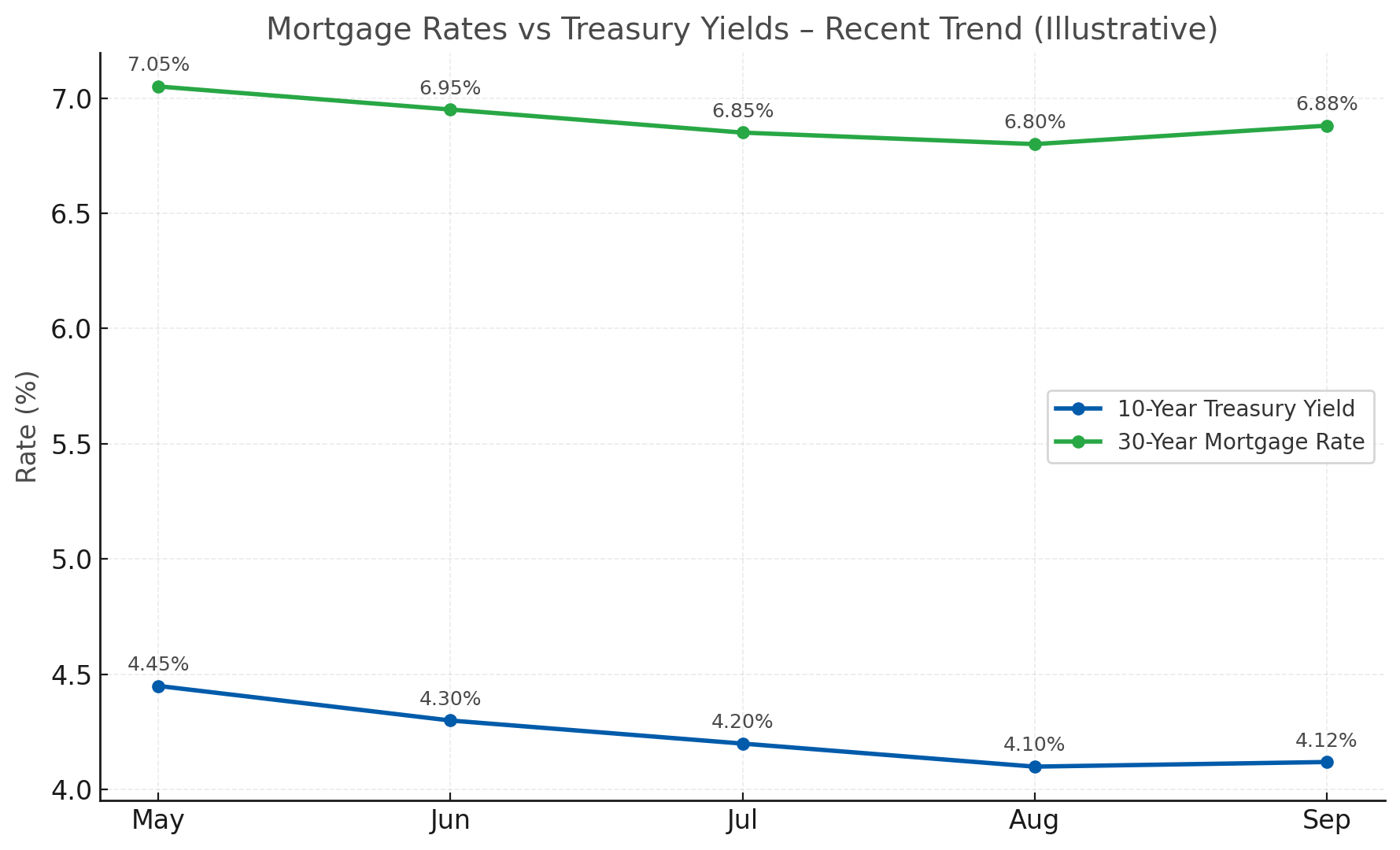

- Mortgage rates respond more to inflation expectations and Treasury yields than the Fed's headline move - declines may be choppy, not linear.

📌 Ready when the right home or rate appears? Get fully pre-approved now so you can act fast.

Why Mortgage Rates Don't Drop Immediately After a Fed Cut

Rates are priced off the bond market, especially the 10-year Treasury. If investors expect slower inflation and weaker growth, yields - and eventually mortgage rates - tend to drift lower. If not, they can stall or rise despite a Fed cut.

Jobs, Claims & Approvals: Lender Behavior in 2025

A cooling jobs market can lead to tighter guidelines. A fully documented, data-driven pre-approval helps you beat competing offers and keep your pricing options open.

Strategy for 2025: Buy, Refinance, or Wait?

- Buyers: Entry-level and move-in-ready homes move fast. Be fully underwritten, rate-ready, and use smart affordability tactics.

- Homeowners (Refi): If a refi improves cash flow or consolidates high-interest debt, act now and set a **strike rate** to revisit later. See our rate volatility explainer.

- Investors: With DSCR, bank-statement, and P&L-only options, the math can still work - especially with a refi plan.

Related Reading

- Central Valley Real Estate Outlook 2025

- Empower Your Clients to Build Wealth Now

- What Drives Wild Swings in Mortgage Rates?

FAQ: Fed Rate Cut & Mortgage Rates 2025

Do mortgage rates fall right after the Fed cuts?

Not always. Mortgage pricing follows bond yields and inflation expectations. If markets doubt lasting disinflation, rates may stall or even rise.

What indicators should I watch?

10-year Treasury yield, CPI/PCE inflation, jobs/claims, and Fed communications. These move bond yields - and therefore mortgage rates.

Is 2025 a good year to refinance?

It depends on your payment, debt mix, and goals. If savings are real today, lock them in and set a strike rate to refi again if/when rates improve.

🚀 Ready to Take the Next Step?

At First Capital Mortgage Inc., we've helped clients succeed in every kind of market for 30+ years. In a volatile rate environment, opportunity favors preparation - full pre-approval, strategy, and the ability to lock when windows open.

We'll help you: choose the right program, compare payments, set a refinance strike rate, and negotiate with confidence.

Prefer to talk now? 📞 CA: 209-522-7100 | TN: 865-444-8422

Disclosure: Rates and guidelines change frequently and vary by borrower profile, property, and program. This post is for educational purposes and is not a commitment to lend. Equal Housing Lender.