Initial Escrow Payment at Closing: Taxes and Insurance

Initial Escrow Payment at Closing

Taxes and Insurance Explained

What's Included in the Initial Escrow Payment?

The exact amount you'll need to deposit depends on several factors:

-

When your property taxes are due (counties may collect semi-annually or annually)

-

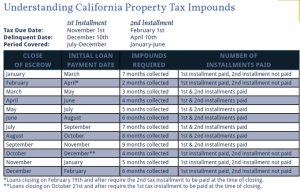

Property Taxes: Due dates vary by county (semi-annually or annually). Your lender collects enough to cover the next tax bill, plus monthly contributions. Payments are typically made a month or more before the due date to avoid late fees.

-

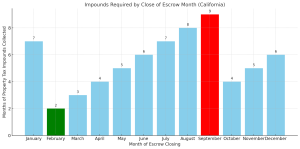

Here's a bar chart that more clearly illustrates how many months of property tax impounds are collected depending on when escrow closes in California:

-

Highest impound: September (9 months) - highlighted in red

-

Lowest impound: February (2 months) - highlighted in green

-

-

-

Homeowners' Insurance: The first year's premium is paid at closing. Your lender collects enough to cover the next installment, plus a 2-month cushion, as required by federal RESPA guidelines.

-

This cushion protects against cost increases and prevents shortages in your escrow account. For California buyers, check out this

Please read my blog on supplemental tax payments to protect yourself, especially in CA.

Why Is This Important?

-

Higher monthly mortgage payments are needed to cover the shortfall.

-

A lump-sum payment to replenish the account.

How Does This Affect My Monthly Mortgage Payment?

-

Principal & Interest: Based on your loan terms.

-

Escrow Portion: Covers taxes (set by the title company) and insurance (based on your agent's quote).

If you have questions about escrow, property taxes, or monthly payments - or just want help understanding what's best for your situation - let's connect.

📅 Schedule a call or shoot me a quick email.

And if any of your friends, family, or co-workers are thinking about buying, selling, or refinancing, can I count on you to introduce us via text or email?

That introduction means the world to me and helps me keep doing what I love.