Mortgage Planning for the Year Ahead: A 2026 Roadmap from a Local Mortgage Broker

Why 2026 is the Year of the “Strategic Borrower”

Gone are the days of simply signing the first loan offer presented to you. As we move into 2026, the mortgage environment requires a more nuanced approach. Economic indicators suggest a stabilizing market, but interest rates and home inventory in California remain dynamic variables. Being a “strategic borrower” means understanding your financial health, knowing your options, and timing your moves effectively.

Strategic borrowing involves three core pillars:

- Preparation: getting your credit and debt-to-income ratio in optimal shape before applying.

- Education: Understanding the difference between loan programs (FHA, Conventional, VA, Jumbo).

- Localization: Knowing how Modesto-specific market trends affect your buying power.

As Steve McNeal often advises, “You wouldn’t accept the first offer at the car lot, so don’t just take your first mortgage offer.” It is time to shop smart and plan ahead.

The Modesto Real Estate Landscape: What to Expect in 2026

Modesto continues to be a unique market within the Central Valley. While Bay Area prices remain astronomical, Modesto offers a blend of affordability and community that attracts families and commuters alike. However, as demand remains steady, inventory fluctuations can impact how quickly you need to move on a property.

Local Market Factors to Watch:

- Inventory Levels: We anticipate a competitive market for single-family homes in desirable school districts.

- New Developments: Keep an eye on new construction growth on the outskirts of the city, which may offer builder incentives combined with our competitive financing.

- Rental Rates vs. Mortgage Payments: With rental costs in Modesto climbing, 2026 may be the tipping point where buying becomes significantly more advantageous for long-term wealth building.

Your 2026 Mortgage Roadmap: A Quarter-by-Quarter Guide

To help you structure your year, we have broken down the mortgage planning process into actionable quarterly goals.

Q1: The Financial Health Check-Up (January - March)

Start the year by analyzing your financial foundation. This is the time to pull your credit reports and correct any errors. If you are planning to buy, avoid opening new credit cards or taking out auto loans, as these can skew your debt-to-income ratio.

Action Item: Contact First Capital Mortgage Inc. for a preliminary consultation. We can help you identify credit improvement strategies that could save you thousands in interest over the life of your loan.

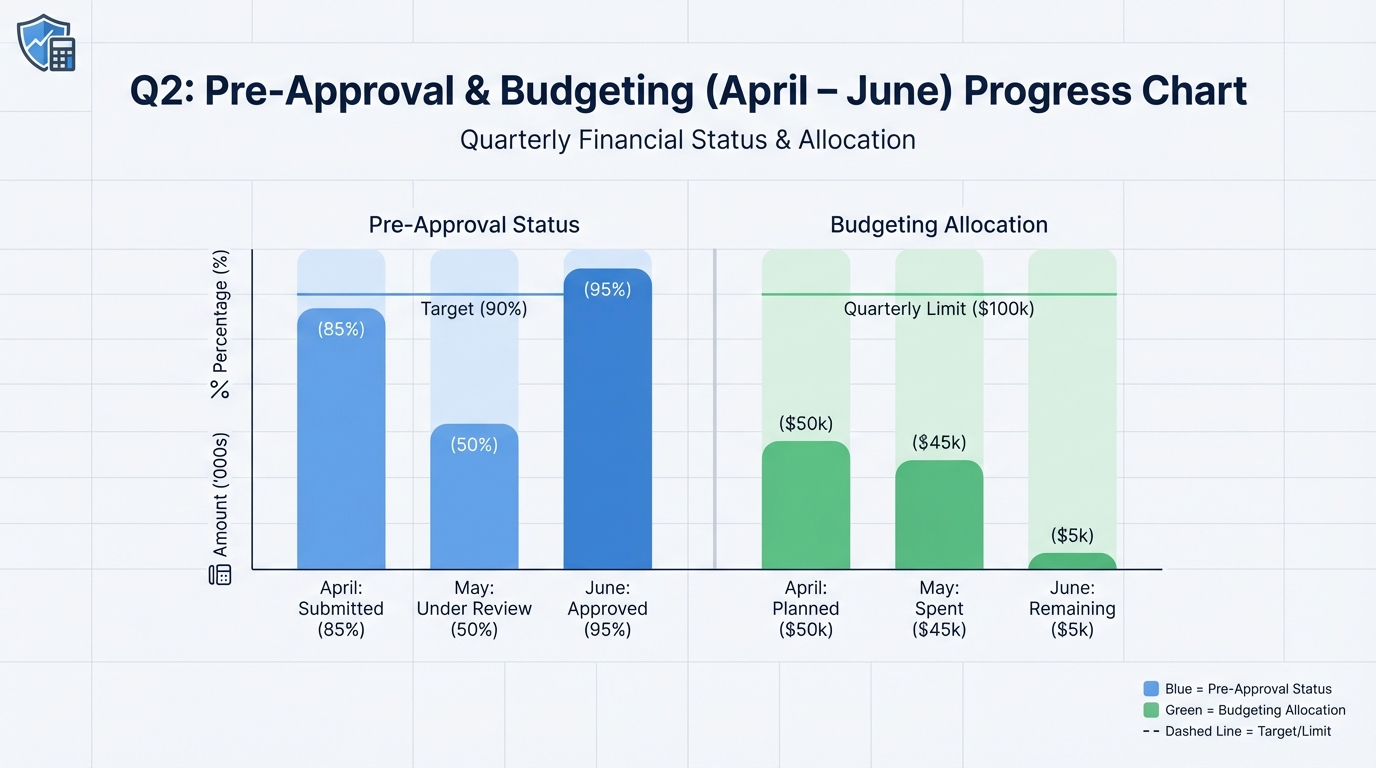

Q2: Pre-Approval & Budgeting (April - June)

At First Capital Mortgage Inc., we make this process seamless. As one of our satisfied clients, Angela, noted: “Can’t believe how fast and simple you made this. We got pre-approved for $580K and were in our dream home less than 3 weeks later.”

Action Item: Get your Pre-Approval Letter now to define exactly how much home you can afford.

Q3: House Hunting & Rate Locking (July - September)

With your pre-approval in hand, you are ready to hunt. When you find a property, the speed of funding becomes critical. Unlike big box banks that can take 45-60 days to close, our local team specializes in fast funding options. We aim to get your loan fully funded in 30 days or less, ensuring you don’t miss out on the house you really want.

Action Item: Utilize our rate comparison tools to ensure you are locking in the best possible terms for your specific scenario.

Q4: Review and Refinance Opportunities (October - December)

Action Item: Use our Refinance Calculator to see if you can lower your monthly payment.

Comparing Loan Options for 2026

Choosing the right loan is just as important as choosing the right house. Below is a comparison of common loan types we offer to help you decide which fits your 2026 goals.

| Loan Type | Best Suited For | Key Benefit | Considerations |

|---|---|---|---|

| Conventional Loan | Borrowers with good credit (620+) and stable income. | Flexible terms (15 or 30 years) and no PMI with 20% down. | Requires a higher credit score than FHA. |

| FHA Loan | First-time buyers or those with lower credit scores. | Low down payment (3.5%) and lenient credit requirements. | Requires Mortgage Insurance Premium (MIP). |

| VA Loan | Veterans, active-duty service members, and eligible spouses. | 0% down payment and no private mortgage insurance (PMI). | Must meet service eligibility requirements. |

| Cash-Out Refinance | Homeowners with significant equity. | Access cash for debt consolidation or home improvements. | Increases your loan balance; requires equity appraisal. |

The Power of Local: Why Choose a Modesto Broker?

Steve McNeal and the team at First Capital Mortgage Inc. provide:

- Personalized Strategy: We don’t use a “one-size-fits-all” algorithm. We look at your complete financial picture.

- Accessibility: You can call us at 209 522-7100 and speak to a human being, not a chatbot.

- Speed: Our streamlined, 100% online loan application is backed by a team that pushes your file through approval quickly and efficiently.

Refinancing: A Strategic Tool for Debt Consolidation

As we head into 2026, many homeowners are sitting on record amounts of equity. A Cash-Out Refinance can be a powerful financial tool. By refinancing your mortgage for more than you owe and taking the difference in cash, you can pay off high-interest credit card debt.

For example, if you have credit card debt at 20%+ APR, rolling that into a mortgage at a much lower rate can save you hundreds, if not thousands, of dollars per month in cash flow. This is a key strategy for financial planning in the coming year.

Frequently Asked Questions (FAQs)

1. What is the difference between getting pre-qualified and pre-approved?

Pre-qualification is a rough estimate of what you might be able to borrow based on self-reported information. Pre-approval is a verified commitment from a lender, based on a review of your finances and credit. In the competitive Modesto market, a pre-approval letter from First Capital Mortgage Inc. carries much more weight with sellers.

2. How much down payment do I really need in 2026?

Many buyers still believe they need 20% down, but that is a myth. FHA loans allow for as little as 3.5% down, and VA loans offer 0% down for eligible veterans. Conventional loans can also be obtained with as little as 3% down for first-time buyers. We can help you find the program that preserves your savings.

3. Is it better to refinance now or wait for rates to drop further?

Trying to time the market perfectly is difficult. If refinancing now can lower your monthly payment, remove mortgage insurance, or help you consolidate high-interest debt, it is often better to act now and start saving immediately. We can provide a “break-even analysis” to show you exactly when your savings will outweigh the closing costs.

4. Can I get a mortgage if I am self-employed?

Yes! While big banks often struggle with self-employed income, independent brokers like First Capital Mortgage Inc. have access to various loan products designed for business owners. We know how to analyze tax returns and bank statements to accurately calculate your qualifying income.

5. How long does the mortgage process take with First Capital Mortgage Inc.?

Our goal is to have your loan fully funded in 30 days or less. By utilizing our streamlined online application and responding quickly to document requests, many of our clients are in their new homes faster than they expected.

Ready to Build Your 2026 Mortgage Plan?

Whether you are looking to buy your dream home in Modesto or refinance to improve your financial position, the year ahead holds incredible promise. Don’t navigate the market alone. Partner with a team that puts your interests first.

Take the first step today:

- Get Your Free Rate Quote in 30 Seconds

- Call Steve McNeal: 209 522-7100

- Email: steve@firstcapitalmortgageinc.com

Let First Capital Mortgage Inc. help you lock in lower rates and achieve your homeownership goals in 2026.