Mortgage Rates and Affordability 2025: Act with Confidence

Mortgage Rates and Affordability 2025: Act with Confidence

Updated October 2025 · First Capital Mortgage Inc.

This refresh brings together our recent posts on mortgage rates and affordability 2025 and shows buyers and agents exactly how to win now - no guesswork, just a clear plan.

What's Changed (and What Hasn't) in Mortgage Rates and Affordability 2025

The latest data points to modest rate relief, persistent inventory constraints, and a mixed - but navigable - macro backdrop.

To ground this update, we monitor:

Freddie Mac PMMS,

FHFA House Price Index,

and NAR Research.

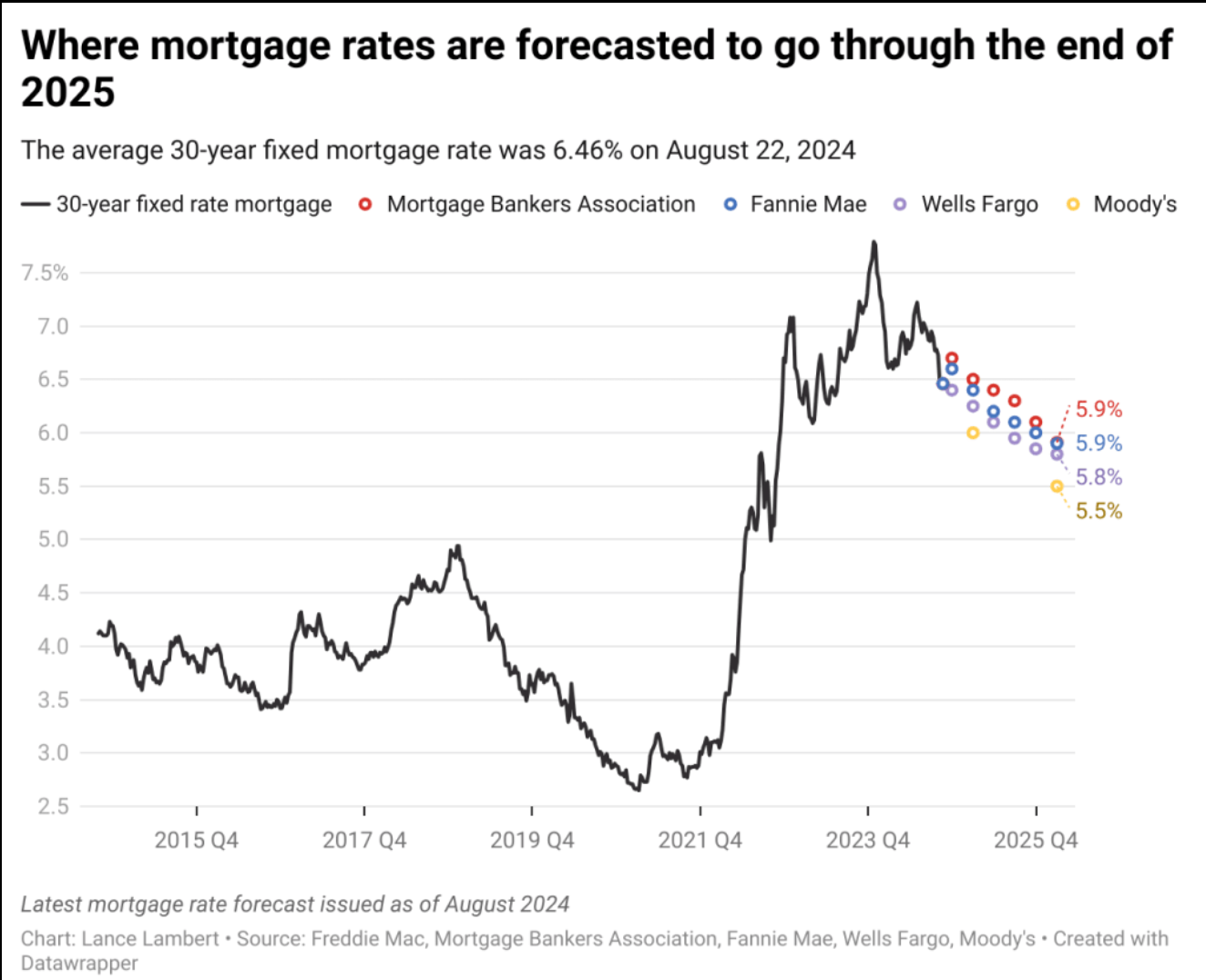

- Rates: Hovering in the high 5% to mid-6% range - stable enough to plan and lock strategically (see PMMS).

- Affordability: Inventory gains are incremental; the best homes still move quickly (track local price trends via FHFA HPI).

- Macro: Labor-softening vs. inflation caution; outcomes are increasingly local (watch NAR for days-on-market/turnover).

Start Here: Anchor Posts to (Re)Read

- Mortgage Rates Update - Week of Oct 3, 2025

- Economic & Market: What the Fed's Moves Mean for Mortgage Rates

- Action Time: Lock Today's Low Rates Before Prices Push Higher

- Knoxville Housing Affordability: Why the Best Homes Still Move Fast

- Central Valley Housing Affordability: Why Affordable Homes Move Fast

- Interest Rates, Housing Inventory & Jobs - Central Valley Outlook 2025

- Buying a Home in 2025 Is One of the Smartest Moves You Can Make

Mini-Playbook for Buyers & Agents

- Situation: What would having a full pre-approval do for your confidence when the right home hits this week?

- Problem Awareness: Where could a 0.25% rate move - or a $10k price bump - knock your budget off track?

- Solution Awareness: If we pair a buydown with seller credits, how much sooner could you win without stretching?

- Consequence: If you wait for a "perfect" rate, what happens if prices climb or your ideal home sells to someone else?

- Commitment: Would it be a bad idea to finish your pre-approval today so you can write a stronger offer tomorrow?

Tactical Checklist (Late 2025) – As rates go down prices are expected to go up!

- Get full pre-approval now: income, assets, credit - fully underwritten if possible.

- Expand your toolbox: ARM options, temporary buydowns, FHA/VA, local grants/incentives.

- Build speed: inspection partners and docs ready; negotiate like the clock is ticking.

- Pick your submarket: Target Central Valley & Knoxville pockets where jobs/in-migration support price resilience.

- Plan to refinance: Capture the home today; re-optimize the rate when conditions allow.

Start Your Pre-Approval

Move from "shopping" to "offer-ready" in hours, not weeks.

Was this helpful?

If this guide added value, a quick Google review helps others find us.

For Agents

Your buyer is only as strong as their financing. Send them here for a same-day pre-approval and a lock plan that matches the home, not just the headline rate.

We'll coordinate credits, buydowns, and timing - so your offer wins.