Strike Rate – Is the time right to purchase or refinance my home?

Strike Rate - Is the Time Right to Purchase or Refinance My Home?

Mortgage rates are moving again, and many homeowners are asking: "When does refinancing or buying truly make sense?"

The answer is finding your personal strike rate - the rate where acting now saves you money and supports your long-term goals.

What Is a Personal Strike Rate?

Your strike rate is the interest rate where refinancing or buying makes real financial sense. It's different for everyone, depending on your loan balance, goals, and time horizon.

If your current rate is 7.00% and you can refinance to 6.00%, you could save about $250 per month on a $400,000 loan.

But if you plan to move soon, the savings might not outweigh the cost. Your strike rate helps you decide - with clarity, not guesswork.

Questions to Ask Before Refinancing

- What is my current rate and mortgage balance?

- How much high-interest debt do I have?

- How much monthly cash flow savings do I need?

- Does it make sense to pay off high-interest debt with equity?

- How many years until I want my house paid off?

- How many years until I retire?

- If I can't pay off my home before retirement, what are my options?

- Is this the home I want to stay in?

- What would it cost to move to the home I really want?

Each of these questions is part of our 30-minute one-on-one consultation. Together, we'll review your numbers, options, and timeline to build a plan that fits your goals.

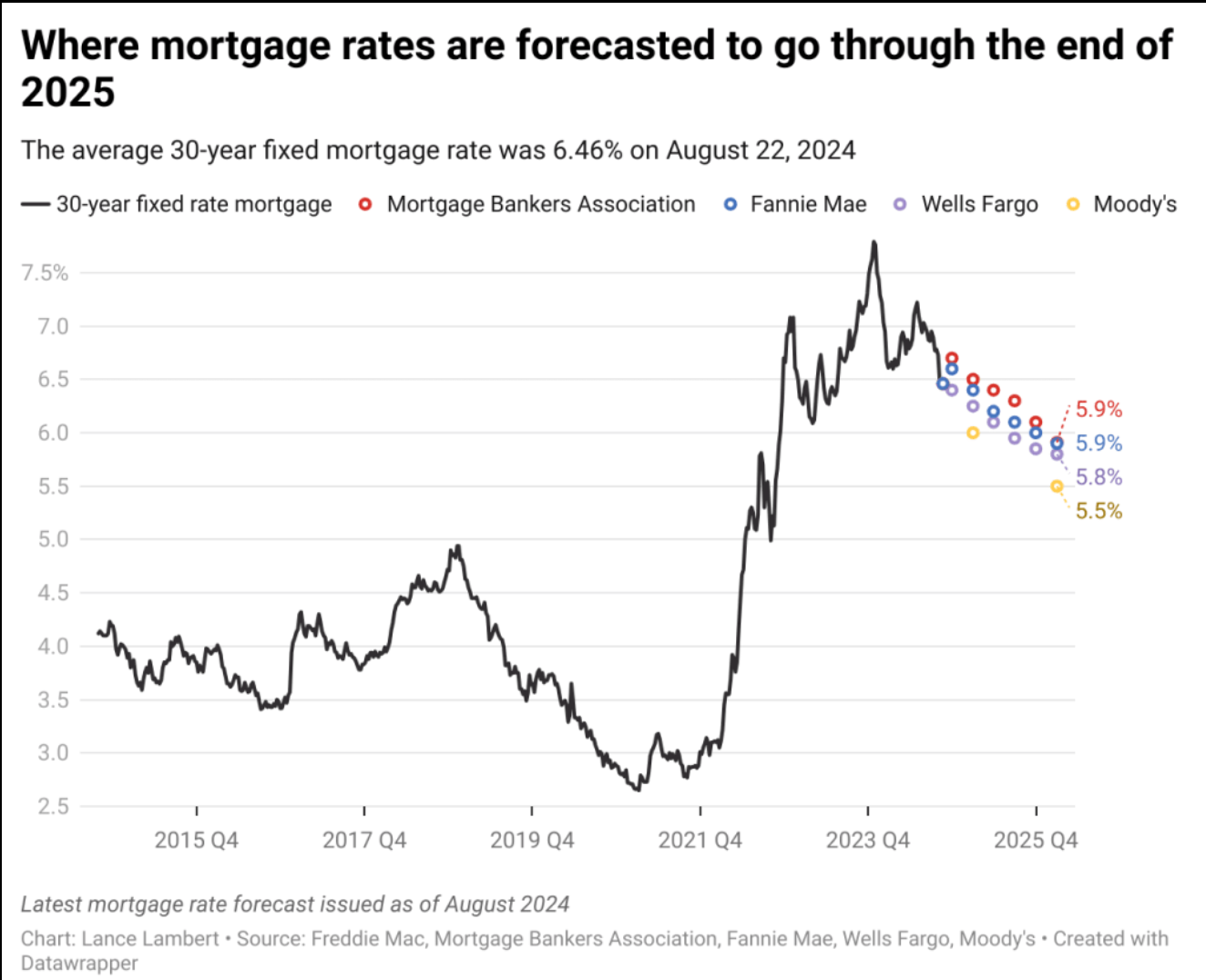

Where Mortgage Rates Are Today

| Date | 30-Yr FRM | Change | 15-Yr FRM | Change |

|---|---|---|---|---|

| Oct 23, 2025 | 6.19% | -0.08% | 5.44% | -0.08% |

| Oct 16, 2025 | 6.27% | -0.03% | 5.52% | -0.01% |

| Oct 09, 2025 | 6.30% | -0.04% | 5.53% | -0.02% |

What If You're Still Renting?

Maybe you don't own a home yet but are wondering if buying makes sense. Waiting for "the perfect rate" often costs more than acting when you're financially ready.

- Home prices continue to edge higher each year.

- Owning builds equity - renting doesn't.

- When rates drop, more buyers compete, raising prices again.

The news often oversimplifies housing and rates. In a short conversation, we can compare your rent, potential payment, and financial picture - no guesswork, no pressure.

Start Your Pre-Approval

Move from “shopping” to “offer-ready” in hours, not weeks.

Was this helpful?

If this guide added value, a quick Google review helps others find us.

Data Sources & Further Reading

- Freddie Mac PMMS - Weekly Mortgage Rate Data

- National Association of REALTORS - September 2025 Market Report

- Also see: Mortgage Rates & Affordability 2025